Upgrading to a Fully Insured sUSDai

Feb 6, 2026|USD.AI drops FiLo, adds Munich Re-backed coverage for GPU loans, improving sUSDai yield with insurance-backed risk protection.

Today we are announcing two changes to USD.AI’s risk architecture: a new partnership with Barker for institutional-grade collateral protection, and the removal of FiLo tranche requirements for new loans.

What FiLo Was and Why We Moved Past It

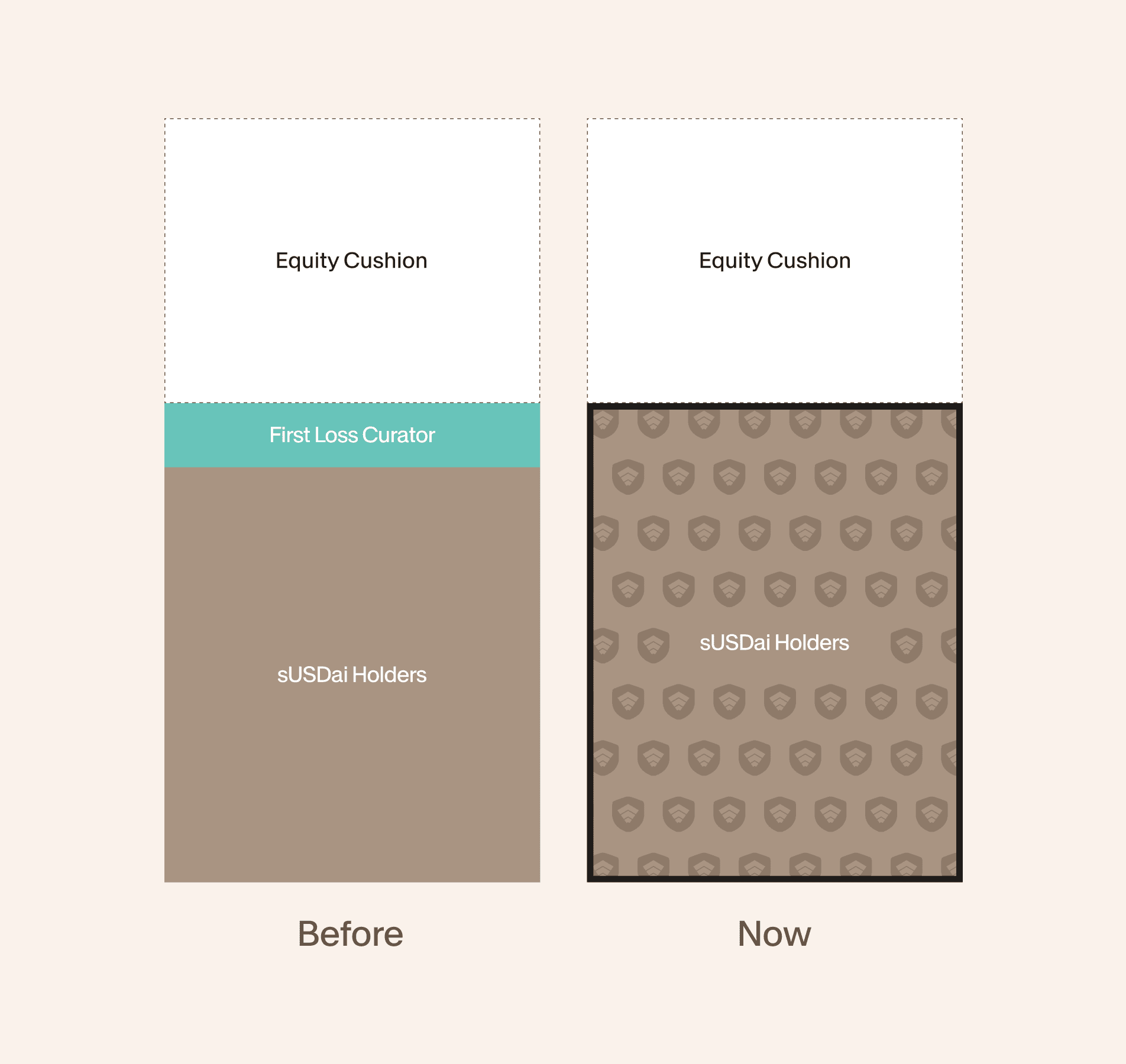

FiLo - “First Loss” - was USD.AI’s mechanism for protecting sUSDai holders against defaults on GPU-backed loans. A junior tranche absorbed losses before they reached stakers. It worked as designed, but it introduced friction for borrowers and locked up capital that could otherwise flow as income to sUSDai holders.

We built FiLo as a first-generation solution with the explicit intention of replacing it when a more capital-efficient structure became available. That structure now exists.

How Barker + Munich Re Coverage Works

Barker is an institutional valuation and risk transfer platform that has facilitated approximately $10 billion in collateral valuations for bulge-bracket banks and specialty lenders. Their domain-specific AI values loan collateral independently, completely separate from USD.AI’s own assessment, and warranties the accuracy of that valuation.

If a borrower defaults and the collateral liquidates below what Barker predicted, Barker is contractually obligated to cover the shortfall directly to the protocol. That obligation is not sitting on a startup’s balance sheet. All coverage is fully reinsured by Munich Re (Great Lakes Insurance SE), an A-rated reinsurer with over 140 years of operating history and hundreds of billions in insured value.

The coverage is structured to net 80% of Barker’s independently assessed collateral value. Because USD.AI caps every loan at a maximum 80% loan-to-value ratio, this is designed to provide coverage for the full outstanding debt amount on each loan. In a default scenario, sUSDai holders have a defined recovery path backed by institutional reinsurance.

This does not eliminate risk entirely. Barker’s AI model carries its own assumptions, and extreme market dislocations in GPU pricing could stress the system beyond predicted ranges. The structure is designed to mitigate default and liquidation risk, not to guarantee that no loss is possible under any scenario.

What Changes for sUSDai Holders

With FiLo tranches removed from new loans, income that previously flowed to junior tranche holders is now directed to sUSDai.

The shift from a capital-reserve model (FiLo) to an insurance-backed model (Barker + Munich Re) changes the risk profile in a specific way: instead of relying on a junior capital buffer that can be depleted, default risk is transferred to a reinsurer built to absorb it. Munich Re does not back collateral programs casually, their participation reflects an independent assessment that USD.AI’s underwriting standards meet institutional thresholds.

Implementation

All new GPU loans issued through USD.AI carry Barker’s value warranty, starting immediately. The first loan under this structure is being issued to Qumulus AI this week.

Existing FiLo tranche positions remain in place and are unaffected. Nothing changes for current FiLo holders. New loans use a synthetic FiLo tranche to cover insurance costs, replacing the capital-intensive junior tranche structure. Future loans may still use traditional FiLo tranches where alignment of interest between sUSDai holders and originating partners makes sense.

This partnership is designed to support the next phase of scaling, the kind of scale where a 140-year-old reinsurer is comfortable attaching their name to our CALIBER collateral framework.