Queue Extractable Value: A New Liquidity Primitive

Sep 19, 2025|How QEV works and creates a market for withdrawals

Most stablecoin projects fail for the same reason banks have failed for centuries: people want their money back faster than the system can hand it over.

The deposits are real, the collateral is real, but liquidity doesn’t always match timing. When that mismatch widens, markets punish it and we see collapses like Luna, Anzen, and Tangible. When liquidity falters, even for a weekend as was Circle’s case, tokens trade below par. Confidence collapses.

USD.AI takes a very different starting point.

We’re not promising instant liquidity against highly liquid collateral like ETH or USDC.

Our loans are fixed-rate, long-dated, and secured by physical GPUs sitting in data centers.

You can’t liquidate a rack of servers overnight to meet a withdrawal. You can, however, count on the fact that every month the protocol’s borrowers make scheduled payments, 3-4% of principal plus interest. That adds up to a predictable cash stream, and it is that stream that services redemptions.

So the real challenge isn’t solvency. As long as borrowers keep paying, the loans perform and capital comes back.

The challenge is sequencing.

What happens when a thousand sUSDai holders line up at the same time, all wanting to redeem against a fixed, monthly inflow of dollars?

Who goes first, who waits, and how do you keep the process fair?

Most of DeFi’s lending protocols sidestep this problem with dynamic interest rates. When utilization spikes, Aave or Compound raise rates until new depositors arrive. It’s an elegant design, but only because the collateral is instantly liquid and the loans are floating-rate.

USD.AI’s GPU loans don’t work that way. The rates don’t move. The amortization schedule doesn’t change.

Queue Extractable Value, or QEV, was built to handle this exact problem.

Every month a portion of the loan value comes back to the protocol.

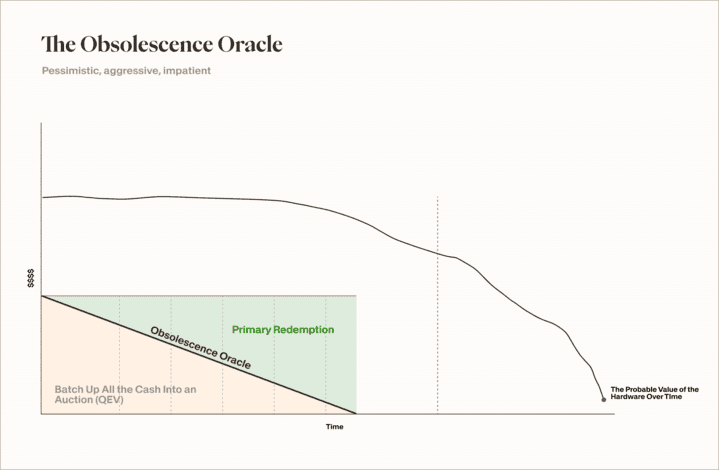

Think of it as a release valve for withdrawal demand. Each month, the system knows in advance exactly how much cash will flow back from loan repayments. That amount, call it Δ, is the pool available for redemptions. If withdrawal requests are smaller than Δ, everyone is paid in order and the queue clears. If requests are larger, the system turns on a sealed-bid auction.

Here’s how it works.

sUSDai holders who want out enter the queue. If demand is low, the funds flow FIFO (first in, first out). If demand is high, the queue becomes market-driven.

Holders in the exit queue bid for priority. To prevent a single whale from capturing everything, the system smooths the results, distributing at least some share across the queue.

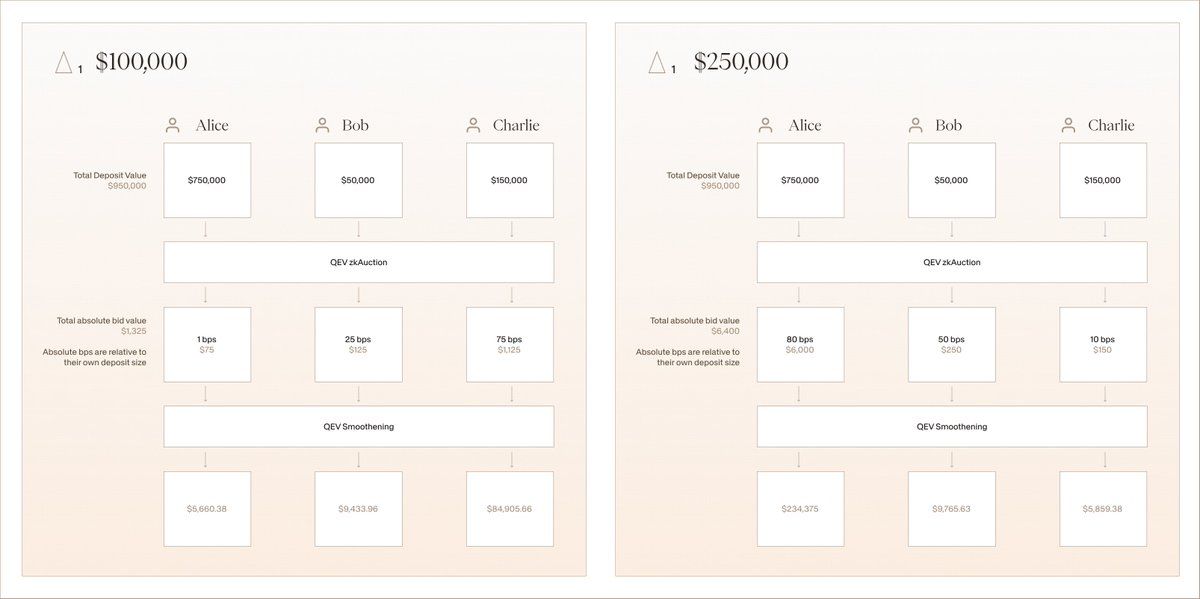

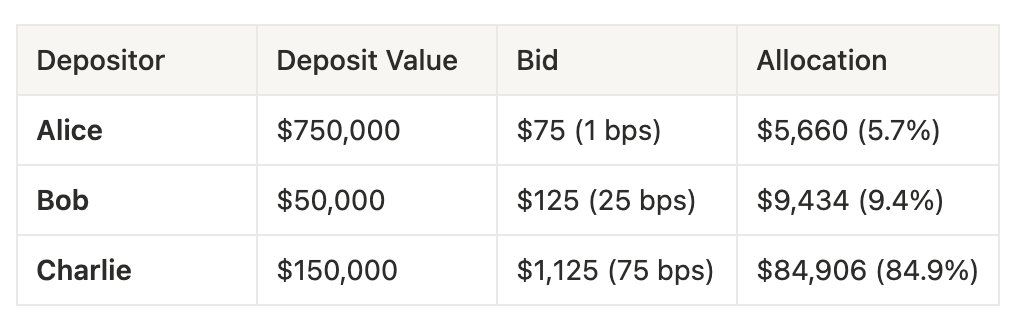

Epoch: Δ = $100,000

For example in epoch 1:

Alice deposited $750k, but only bids $75 (1 bps). She wins a small share of liquidity ($5,660, or 5.6%).

Bob deposited $50k and bids $125 (25 bps). He wins $9,433 (9.4%).

Charlie deposited $150k and bids $1,125 (75 bps). He wins $84,905 (84.9%).

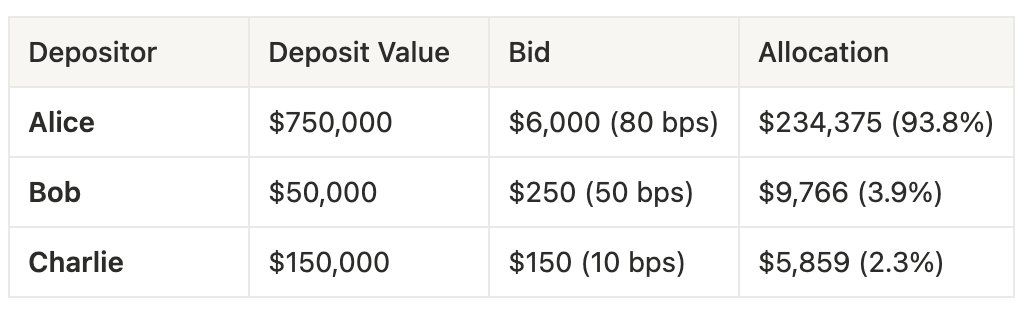

Epoch: Δ = $250,000

In epoch 2, things change a bit, there’s more capital being returned and Alice is willing to bid a higher amount. This time she bids 80bps or $6,000. This time the outcome would give her most of the liquidity.

The rules are simple: the higher your bid relative to others, the larger your slice of the redemption pool. All bids are private, using zero-knowledge proofs, so no one can game the system by peeking at the last moment. And importantly, the auction fees don’t vanish into thin air. They flow back into the protocol, rewarding patient lenders who wait their turn.

What QEV accomplishes is subtle but important.

It doesn’t change the fact that loans are illiquid, or that redemptions take time.

What it does is turn that time into a market.

Urgency is priced by the sUSDai holder demand, par redemption is preserved, and the system stays transparent. The result is a lending market that can scale into the billions without depending on quick collateral sales or brittle interest rate games.

While not a copy of any single TradFi or DeFi mechanism, it rhymes with several:

- Interval and tender-offer funds repurchase on a schedule with proration when requests exceed the window. That is time-boxed capacity with a rule-based allocation. QEV similarly uses periodic windows, but replaces proration with a sealed auction for priority.

- Validator withdrawal queues on Ethereum process exits at a churn-limited rate. That is a protocol-level throughput constraint with a public queue. QEV has a similar constraint, but the order is market-driven rather than fixed.

- MEV-Boost and proposer-builder separation auction sequence rights to allocate scarce blockspace. QEV adapts the sequencing market to redemption priority, with privacy to prevent last-block gaming.

- Money market funds’ liquidity tools shift redemption costs to exiting investors during stress events. QEV accomplishes a similar fairness principle by making urgency explicit and paid, rather than diluting patient holders.

What QEV is not

- It is not dynamic-rate management. Borrowers do not get repriced because lenders want out.

- It is not an oracle-driven liquidation system. We do not sell GPUs to meet a spike in exits.

- It is not a promise of instant liquidity in all states. It is a promise of predictable liquidity, priced by demand against a posted schedule.

The most important thing is that redemptions are not a promise of instant liquidity, but a promise of liquidity over time. That distinction is what allows GPU-backed loans to finance real assets, while still offering lenders a clear and fair way to exit.

If borrowers are performing, we should not ask them to subsidize temporary exit pressure. QEV lets lenders exit fairly, it pays patient lenders with the urgency premium, and it keeps the system focused on financing productive assets.

You can always redeem at par over time with USD.AI as long as the assets do not default. QEV makes that path explicit, prices the time preference cleanly, and avoids the reflexive loops that wreck illiquid-backed coins.

Scale requires honoring time.