How USD.AI GPU Loans Work

Oct 16, 2025|Discover how USD.AI turns GPUs into bankable assets—underwriting loans backed by real compute power to fuel the AI economy.

Over the past two months, USDai and sUSDai have seen explosive growth. The deposit caps have filled in seconds, however, one of the most common questions is: “How do GPU loans actually work?”

USD.AI is built on a simple premise, that compute power is the new form of collateral.

Just as banks once lent against gold and real estate, GPUs are now the collateral used in USD.AI's onchain lending protocol, the core infrastructure powering AI models and cloud compute.

To understand how the protocol enables this asset backed borrowing, it helps to remember that the protocol has two sides:

- USDai — a fully backed synthetic US dollar. It’s 100% collateralized by U.S. Treasuries and cash equivalents.

- sUSDai — the yield-bearing version of USDai. It earns income from both Treasury yields and GPU loan interest.

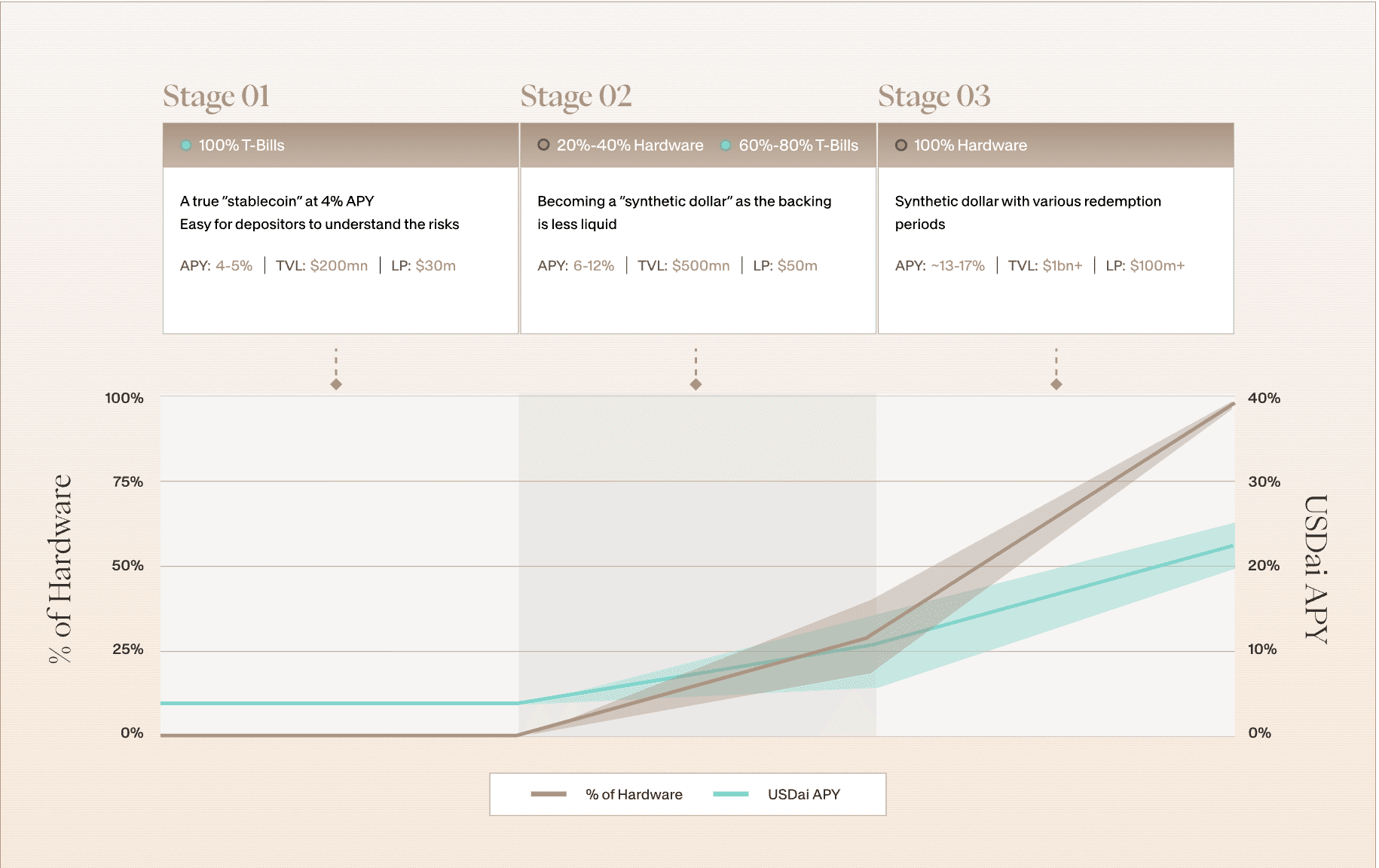

This two-token system is designed to bridge traditional finance and on-chain infrastructure. Treasury yields provide stability; GPU loans provide growth. Together, they form the foundation of a real, revenue-backed synthetic dollar.

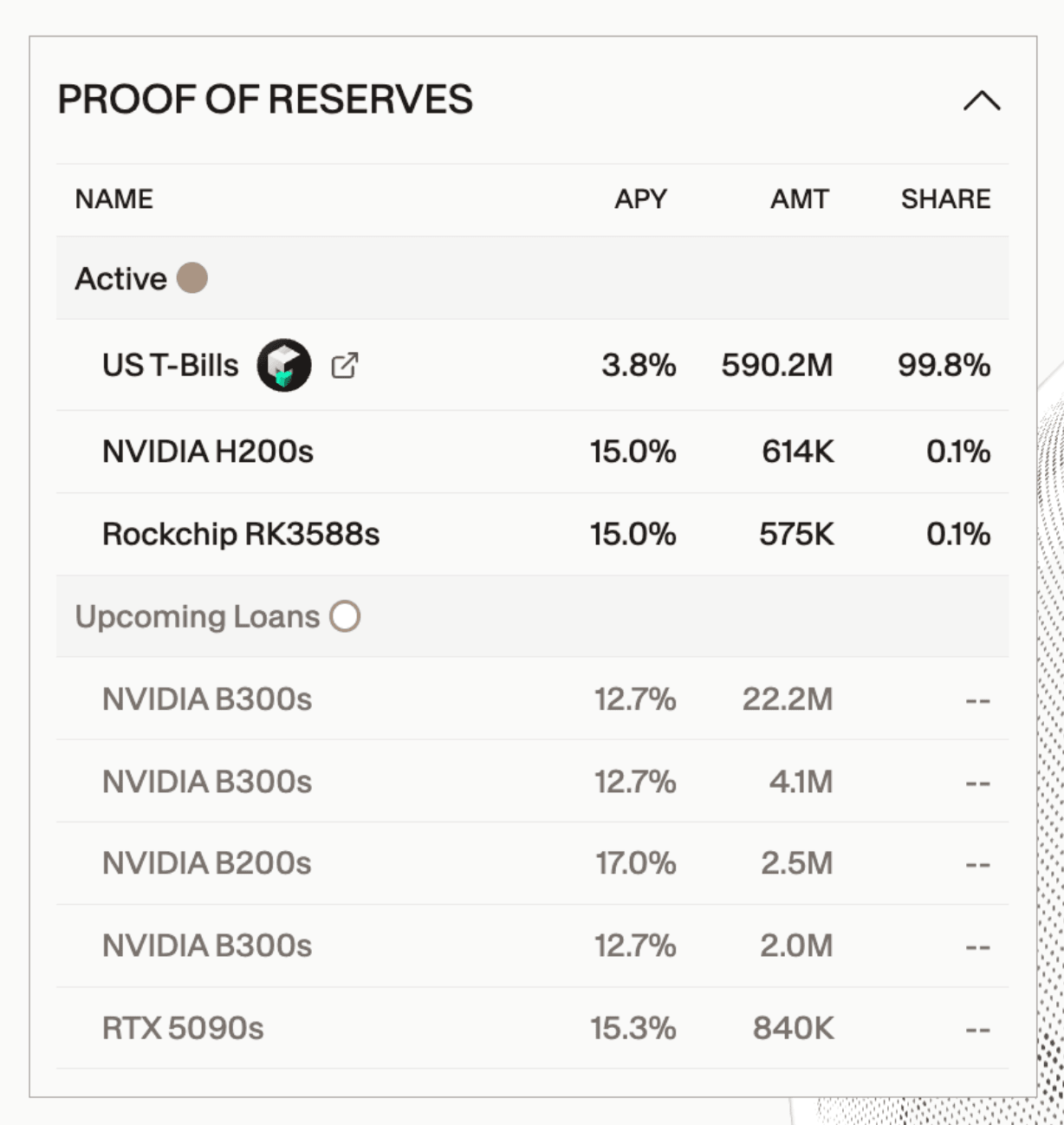

At the moment, 99% of sUSDai is backed by Treasuries while the remaining share comes from GPU loans. As demand for credit from the protocol grows, the composition will shift toward a mix of hardware and treasuries, blending predictable yield with high-performance collateral.

But what does that actually look like on the borrower’s side?

Every loan at USD.AI starts with three simple questions:

1. Asset Verification: What GPUs are being pledged?

This is the foundation. It's the C (collateral) in CALIBER. What is the value of the assets you own?

When GPU owners want to obtain credit from the protocol, the FiLo Curator will first determine exactly what GPUs are owned and their value.

Pricing for the GPU valuations comes straight from two places:

- For new chips, pricing is based on NVIDIA’s official OEM price. That number is set globally and can’t be inflated by resellers.

- For used chips, pricing is based on data from secondary-market brokers such as HydraHost, Procurri, and Blockware, who actively market make the wholesale GPU market.

These valuations define the collateral basis for GWRT issuance.

2. Location and Insurability: Where is the hardware located?

Insurability is the most important requirement for CALIBER eligibility.

GPUs must be stored in a verified, insurable data center located in a jurisdiction with strong legal protections, enforceable contracts, and established coverage markets.

If the hardware sits in a country without recognized insurers, or in a facility that lacks audited security and environmental controls, it doesn't qualify for CALIBER and it can’t be onboarded. There’s simply no way to price the risk of issuing the GWRT.

Insurance is what turns a GPU from a high-tech gadget into a bankable financial asset

Here’s how it works in practice:

- Before funding, curators verify the data center operator (known legally as the bailee) and ensure that they can issue a warehouse receipt acknowledging physical custody of the hardware.

- The hardware must carry full replacement-value insurance, naming the bailee and lender as insured parties.

- Only after those conditions are met can a borrower be issued a GWRT by the tokenizing agent.

If anything happens, fire, flood, theft, or other acts of God, the GPUs are covered, and the protocol can recover or liquidate the assets through our broker network.

So when curators ask “Where are they located?” the real question is:

Can the GPUs be insured? Because without insurance, there is no CALIBER.

3. What Is the Offtake/Service Agreement?

This question is about one thing: how does the GPU borrow earn revenues to pay back their loans?

Each GPU-backed position depends on two primary factors:

- The hardware must hold its value long enough for the loan to be paid off.

- The borrower must have predictable revenue from offtake agreements to service the debt.

If both line up, the borrower qualifies to access credit from the protocol.

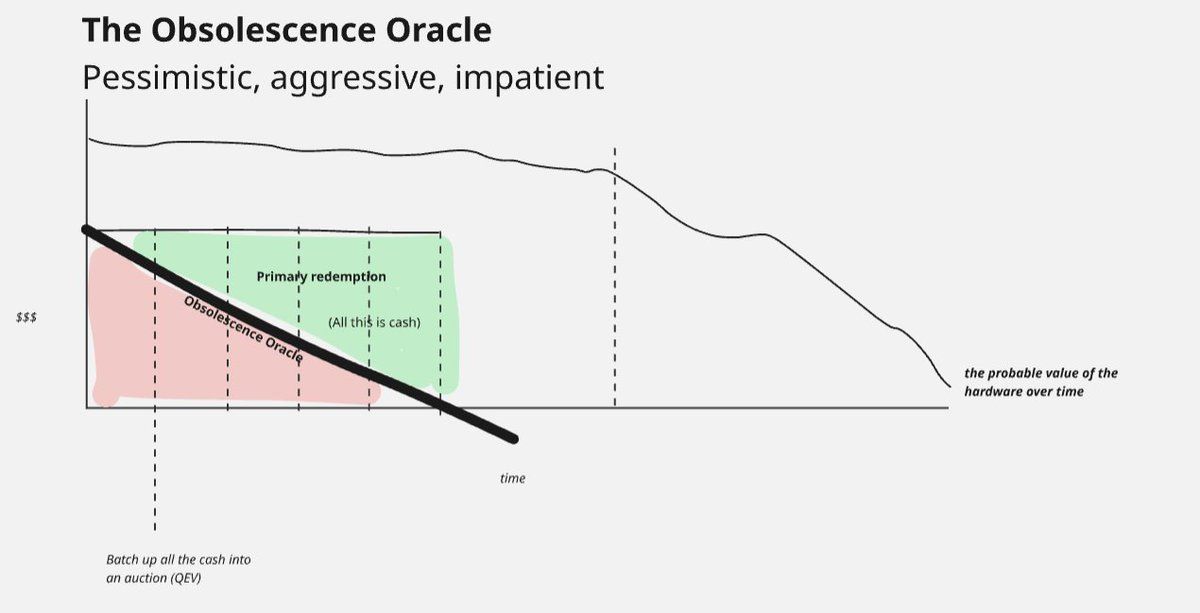

Staying Ahead of Depreciation

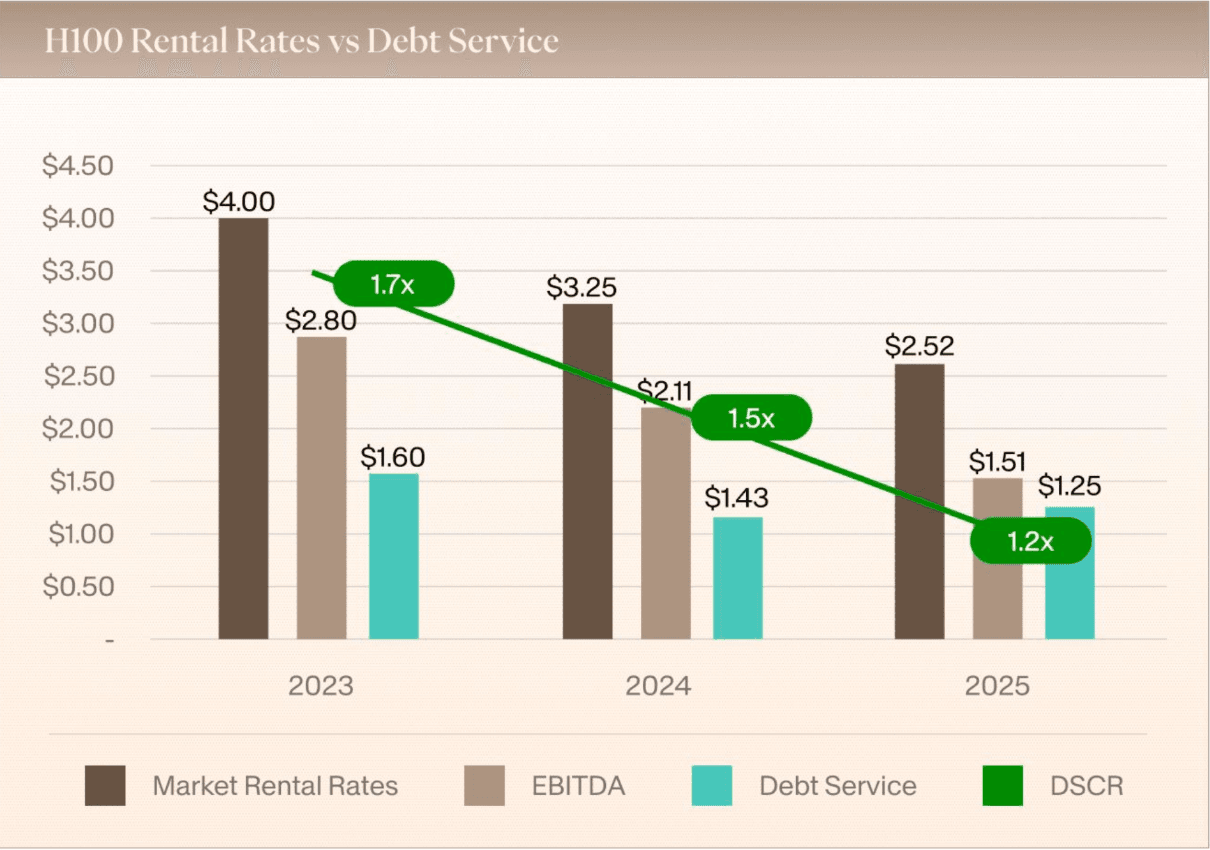

GPU depreciation is driven primarily by market rental rates, what the chips can earn per hour.

The below graph illustrates market rental rates and EBITDA per GPU hour for H100s from 2023 to 2025 versus debt service per GPU hour assuming a 3 year loan duration with straight line amortization.

While coverage ratios obviously compressed due to rate decline, borrowers had ample cash flow to meet debt payments in each of the three years (with room for further debt paydown). Additionally, after year 3, the borrower has fully paid off his debt, with an asset that is retaining ~50% residual value and continuing to print 60%+ EBITDA margins.

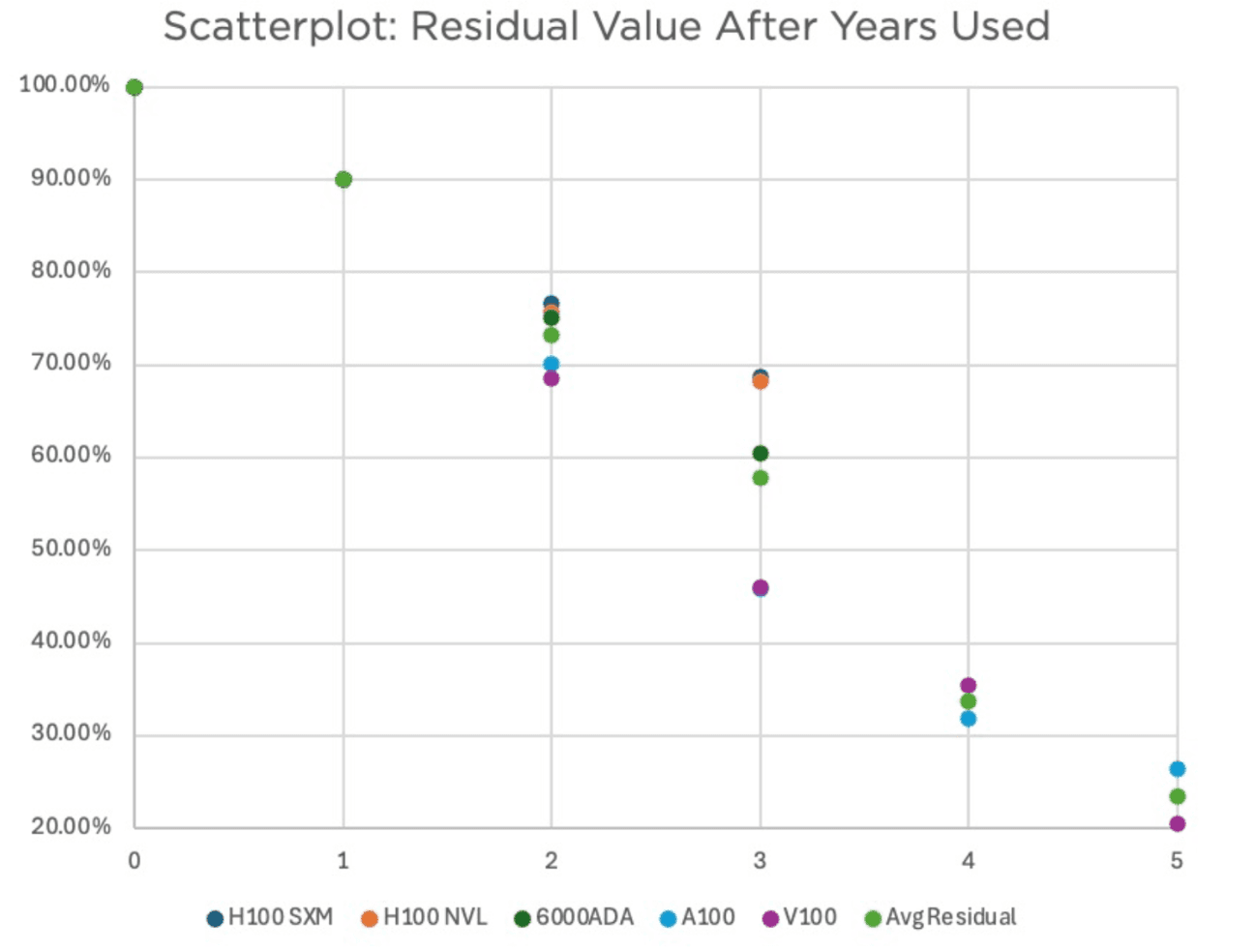

On the asset side, Hydra’s Longevity Study shows that depreciation on H100s tracks almost perfectly with these rental trends. After 1.5 years, H100 resale values are roughly 80% of their original price, and after 3 years, about 50%. That works out to ~17% annual depreciation, which inform protocol assumptions used by FiLo Curators during underwriting.

To stay aligned with asset depreciation, GPU-backed credit positions within USD.AI amortize over three years, enabling principal repayment schedules that outpace hardware value decay.

Predictable Offtake = Predictable Repayment

The other half of the equation is the borrower’s offtake; the contracts that generate revenue.

Not all compute income is created equal.

A borrower with a three-year fixed contract with a large, creditworthy tenant represents a very different risk profile than one selling spot or burst compute to transient customers. While these inputs won’t affect the valuations of the hardware, they could have a significant impact on interest rates paid by the borrower.

So before originating a loan, the curators model:

- Depreciation: the expected resale value of the GPUs, month by month.

- Income stability: the borrower’s offtake contracts, counterparty risk, and expected utilization rate.

Only when both models align, meaning the revenue covers debt service and the collateral retains sufficient value, will a FiLo curator fund the first loss of a loan.

Closing Thoughts

Each GPU-backed credit position within the USD.AI ecosystem is evaluated through the same disciplined framework: What equipment do you have? Where is it? And how will it earn revenue?

Through CALIBER and FILO curation, the protocol introduces structured, transparent standards to on-chain finance, transforming compute infrastructure into a verifiable, collateralized asset class.