Why Banks Can't Fund The GPU Revolution

Dec 16, 2025|Why Banks Can't Fund The GPU Revolution (And Why USDai Can Beat Private Credit)

When we started USD.AI, the first thing we did was buy several AI GPUs and immediately approach a bank for equipment financing (watch at 2min).

In almost any other industry, this is a routine process.

Want to finance a $450 million Airbus A380? Banks have specialized equipment financing for that.

Need to finance a fleet of forklifts? Banks are covered and issue billions in equipment loans every year.

So, we were shocked when we called a bank asking for a GPU mortgage and were politely told no.

We called another, and another, nearly every major bank in the world, and they all gave us the same answer.

They would not provide asset-backed lending for GPUs.

This was a major paradox for us.

We are in the middle of the largest infrastructure boom in history as the globe rapidly builds “AI Factories” to generate the world’s newest commodity: AI Compute.

The sheer scale of the build-out is staggering, with an estimated $1 trillion to $3 trillion through 2028 just for GPUs and their supporting infrastructure.

Yet, banks were nowhere to be found.

We quickly learned the banks were "sidelining" themselves intentionally.

This largest-ever capital expenditure for GPU’s in the history of man was being funded almost exclusively by private credit funds like Blackstone and Magnetar, but their cost of capital was at a premium.

As we researched why the banks were sidelined, we found that commercial banks are hamstrung by regulatory requirements under Basel III, an international framework that dictates how much capital they must hold against different types of loans.

The system works well for stable assets like mortgages but catastrophically fails when applied to depreciating technology like GPUs.

With bank financing not an option, private credit is bearing the underwriting risk, and they charge a premium for their capital.

It's this structural gap which gives USD.AI a potential advantage to outcompete both banks and private credit by providing lower cost of capital to those who want GPU mortgages delivered faster and with less fees.

The standoff: Why neoclouds are starved for cash

For Bitcoiners, the current craziness in the AI infrastructure markets isn't that crazy.

Demand for AI is driving buildout of data centers at an enormous scale (similar to the first few BTC bull runs). Everyone wants GPUs, no one has enough power or racks to run them.

NVIDIA claims they have a half trillion dollars of back orders (at this size the numbers aren't even comprehensible). Just for context this is half Bitcoin's market cap...

But where is all the money coming from?

Billions of dollars is needed every year to purchase the latest NVIDIA chips and then burn them to the ground creating compute over the next 4-5 years.

And the craziest (Author's note: we're sorry about all of the surperlatives) detail about this GPU growth story is that its is effectively 0% funded by banks.

Private credit has won, the banks have ceded control of GPU financing.

But why does the matter at all?

It's all economics and who has access to the lowest cost of capital and how fast they can acquire it.

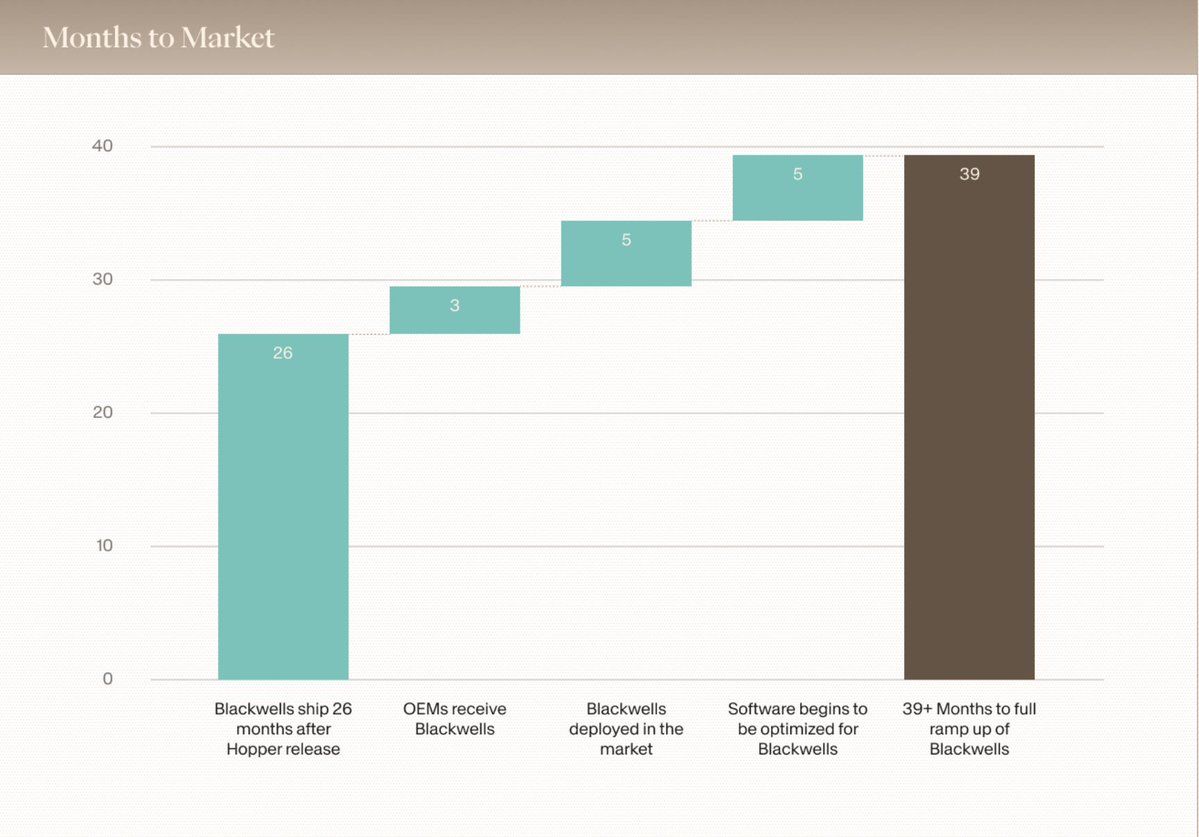

On average it takes 40 months for a new NVIDA chip to hit full saturation.

NVIDIA chips cycle through their useful life on average every 40 months as each generation saturates the market. We're right in the middle of Blackwell's reign, but the next generation Rubin's are poised for launch in 2026.

Neocloud operators not only have to find the cheapest interest rates, they also need to source the debt within the fastest period to remain competitive. A 6 month delay in financing while your company goes through due diligence could threaten your entire revenue model.

The bank problem: Regulatory friction and risk weights

You might assume that JPMorgan or Citi could simply write a check for a GPU fleet. After all, they have the cash, and they also, in theory, should be able to provide the lowest interest rates.

But modern banking regulations under Basel III make this nearly impossible, even when the underlying business is sound and the collateral is real.

Basel Banking Regulations

Basel III is the current set of regulatory rules for banks that determine how much equity capital is needed against their portfolio of risk weighted assets (RWAs, yes its the same as cryptos ironic real world asset 'RWA' monkier, but for this article we'll use the banks language.)

Risk weighting just means that not all assets are created equal. Cash is riskless, followed by treasuries, gold, then secured loans, corporate bonds, securities, and finally GPUs.

Banks need equity (capital reserves) based on the risk weighting. The more risk, the more equity needed. And institutions pay a premium for equity, typically costing 10-15% annually to maintain.

The third version of Basel was born out of the 2008 global financial crisis after the regulators watched as the banks almost cause the world's financial engine blow up. Post-GFC regulators decided banks should not be risk taking institutions, who also serve as the bedrock for the global economy. Banks lost their economic advantage to lend against risky assets for societies benefit and its had significant effects on GPU financing.

You can probably guess the credit rating of GPUs: Weak.

Running a GPU business means raising billions in capital to buy magic boxes that make money, with all of the equipment practically worthless after 5 years, and held in a newly formed Special Purpose Vehicles (SPVs) or new entities (PropCos).

SPVs are the choice-de-jour for GPU operators as they allow the parent company to keep rapidly depreciating machines from tainting their precious balance sheets to preserve leverage ratios and credit ratings.

It's pure financial engineering and it has a direct and punitive effect on bank lending.

First, the holding co (SPVs) are new, unrated, and bankruptcy-remote from their parent, plus they have no credit history.... meaning from the start the weighting is 100%.

Large Public Co's like Meta normally get a preferential 65% "Investment Grade" exception, but even they are using SPV's to finance their GPU installations. Meta does not want to lose its privileged investment grade corporate rating, supported by its enormous earnings.

For "Project Hyperion" Meta retained a minority equity stake (approximately 20%) while asset management firms (private credit) like Blue Owl Capital provided the majority of the funding (around 80%). Meta’s kept billions off its balance sheet, while maintaining control of the GPU’s and facility.

Let's consider a standard $100 million term loan to an unrated SPV holding NVIDIA H100 GPUs.

- Pre-Basel III: Risk weight = 50-60%.

- Capital Required (at 10.5% Total Capital): $100m x 60% x 10.5% = $6.3 million.

- Basel III: Risk weight = 100%

- Capital Required (at 10.5% Total Capital): $100m x 100% x 10.5% = $10.5 million.

So with the new Basel III rule set the bank faces a ~67% increase in the capital required for the exact same exposure. To compensate, banks are forced to charge interest rates well above what the private markets are offering, so naturally they just exit the market completely.

Specialized Lending and the Punitive Slotting of Object Finance

Even if SPV/PropCos would receive a carve out expectation, the real issue is with the chips themselves.

Just to recap, GPUs are expensive magic boxes that immediately start losing all of their value, eventually ending up worthless in under a decade.

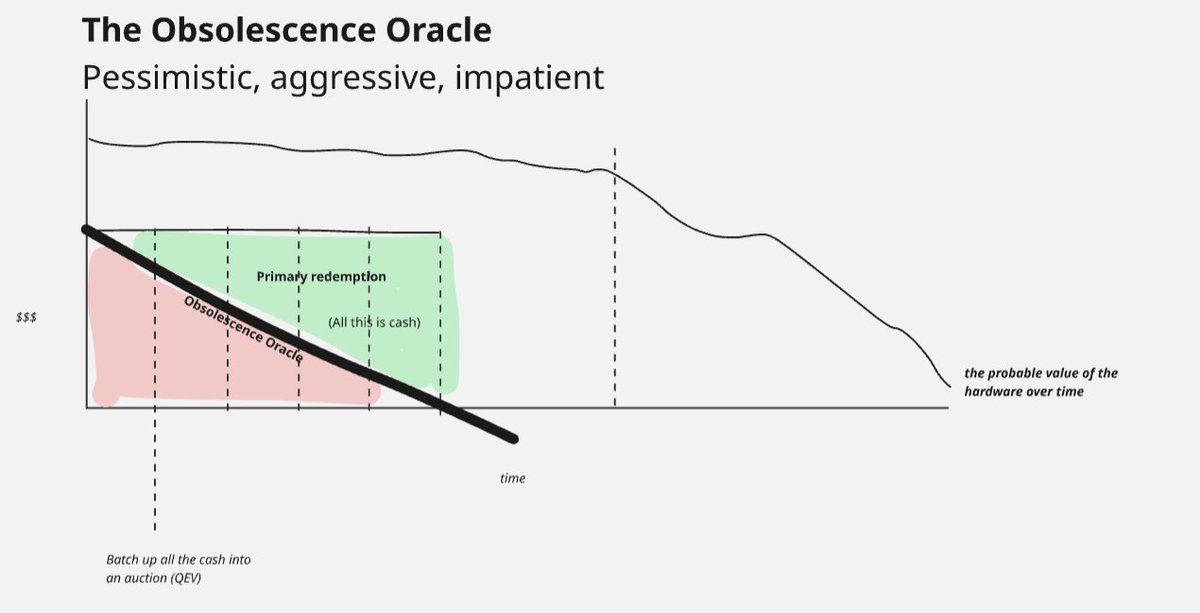

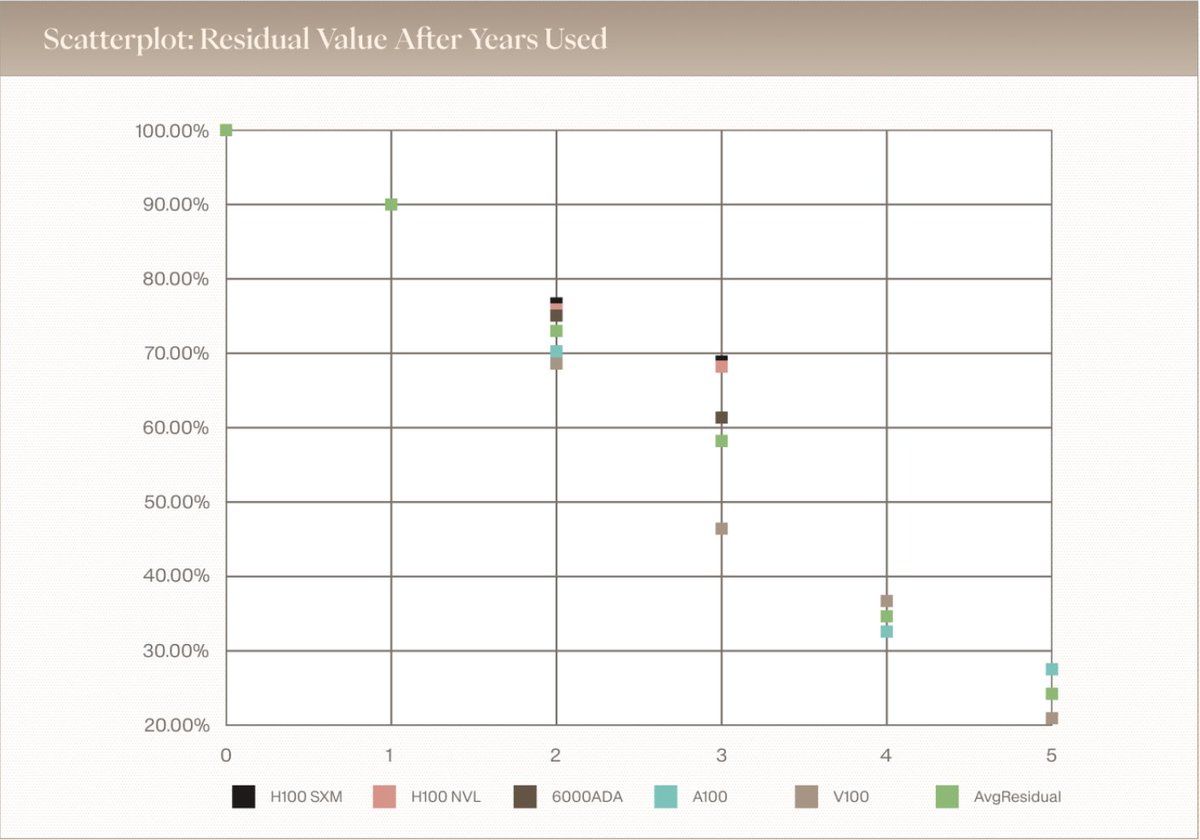

How long you think this life is up for discussion. The Hyperscalers and Coreweave think GPUs last 5-6 years. Michael Burry thinks its closer to 3 years, a view we also take at USD.AI.

Based on secondary market price data, GPUs maintain 60% of their value through 3 years and then rapidly drop to 20-30%. This matches NVIDIA's 40 month distribution cycle shown above.

The operators of these chips don't plan to recoup their money through reselling their magic boxes at the end of 5 years. All of their revenue will come from cash flows generated by the GPUs themselves.

This squarely categorizes GPU financing as Specialized Lending, and more specifically its a sub-class called Object Finance.

Object Finance as a method of funding the acquisition of physical assets (e.g., ships, aircraft, satellites) where the repayment of the exposure is dependent on the cash flows generated by the specific assets that have been financed and pledged to the lender. GPUs, as discrete, income-generating compute assets leased to third parties, fit this definition perfectly.

GPU prices are extremely volatile, shifting month to month based on new chip production. Pair this with potentially highly volatile revenue from their offtakers and its a recipe for a "double default," where both demand for AI compute and collateral values can crash simultaneously, creating massive risk for the bank.

In other industries the banks' internal risk teams would comb through years of data. But ChatGPT is only 3 years old. We have no idea what the size or demand for AI compute will be in 5 years (other than the constant trillion-dollar superlatives).

While NVIDIA isn't Enron, the chips might be worth a lot less than we think.

Fearing another global financial crisis, the banks, in addition to the 100% Weak RWA, must also penalize GPUs under Object Finance rules, bringing the ultimate weight for GPU financing to 115%-250%, halving their lending efficiency and all together killing off any hope of banks providing GPU financing.

Too Short for Syndication and Securitization

One of the core functions of a bank is to gather debt through syndication, then sell it onwards through securitization. Normally banks are dealing with corporate debt, homes, cars, etc.. Low risk assets that are plentiful and ubiquitous across the globe.

It’s relatively easy for banks to source $100m worth of mortgage backed securities or car loan securities from a variety of localized markets, package it up and sell it off. This process can be accomplished in 3-9 months as the market is liquid.

Specialized debt, as per its name, is more esoteric and thus harder to package and sell.

A single neocloud buying $100m worth of GPU’s needs months of capital raising and negotiations. There's no "standardized" contract for GPU mortgages. Even after the contracts are finalized, the rating agencies like Kroll or Fitch take much longer to grade these deals because they have to model unique risks. This all happens before the debt is sold off to investors, meaning the banks might hold it on their balance sheet for 12+ months.

And so, by the time the banks complete their issuance, securitization and distribution lifecycle, the chips could already be halfway through their economic useful life.

The result is predictable: most GPU financing requests never make it past the initial screening at traditional banks.

Credit officers look at the depreciation curve, take a glance at their risk weightings, and pass on the opportunity regardless of the borrower's creditworthiness.

The private credit stopgap: Flexible but expensive

If banks are locked out of GPU financing, who's actually funding the AI infrastructure boom?

Primarily, it's private credit funds, firms like Blackstone, Magnetar, and specialized asset-backed lenders. As these funds are not regulated, they can originate loans faster and more flexibly than banks, but they come with a significant cost that flows directly to borrowers.

Private credit funds aren't lending their own money in the way a bank might lend from deposits. Instead, they're deploying capital on behalf of Limited Partners, or LPs, pension funds, endowments, and family offices that expect premium returns for locking up their money in illiquid, complex assets.

LPs in these vehicles expect net returns of 10-15% depending on risk. After the fund manager takes their 1.5% management fee and 15-20% performance fee, the borrower ends up paying effective interest rates closer to 18-20%.

When banks, who are fundamentally regulated and subsidized by the government to allow for banker profits and potentially socialized losses, exit a market like GPU financing, their high-cost private credit replacements force borrowers to pay the true, full-price cost of capital.

The cost reality for neoclouds

For GPU operators, this expensive capital acts as a tax on every transaction they process. The numbers from recent deals illustrate the challenge:

- Double-digit interest rates: CoreWeave's weighted average interest rate on short-term debt was reported at 12.3% as of mid-2025. Recent facilities in the sector are priced at SOFR plus spreads of 4-7%, putting base coupons at roughly 8.3-11.3%.

- Hidden equity kickers: Lenders frequently demand warrants, options to buy stock at favorable prices, as deal sweeteners. CoreWeave carries significant warrant liabilities on its balance sheet as a result of these arrangements.

- Leasing premiums: Sale-leaseback structures typically cost 7-10% of hardware value annually. Combined with depreciation, neoclouds face enormous cash flow requirements just to service their financing before generating any profit.

The Banks’ Backdoor Arbitrage

The funniest part of this whole situation is that ironically, Basel III encourages banks to lend to private credit funds rather than to the GPU assets directly.

Banks can loan investment-grade regulated funds (like Business Development Companies - BDCs) or subscription lines secured by LP commitments with a 20-100% RWA. The subscription line must be backed by uncalled collateral and its risk-weighted to the institution.

In this regard, banks are the "wholesalers" of liquidity to private credit funds, who then act as the "retailers" of high-risk GPU financing.

This shifts the asset-level risk entirely outside the regulated banking perimeter, achieving the regulatory goal of de-risking banks but simultaneously fueling the growth of the shadow banking sector.

The USD.AI solution: Structural arbitrage

Only in truly free markets do you achieve parity. With banks inability to lend to Neoclouds at subsidized rates, USD.AI has a special, limited window to outcompete private credit.

Esoteric, fast depreciating, specialized debt in a novel market is a perfect fit for DeFi, whose greatest strength is the ability to coordinate capital quickly and efficiently.

A billion dollars in stablecoins can flow into a protocol’s coffers in a few seconds, enabling swaps, money and capital markets to rapidly scale.

What we've designed at USD.AI is a cheaper, faster, and safer system than what public or private credit markets currently provide.

Tokenization: Brings origination costs for already installed and revenue-generating GPUs to just a single transaction on Arbitrum, pennies or less.

Additionally, all of USD.AIs loans are asset-backed, fully collateralized, and non-recourse, directly aligning with SPV legal structures.

Stablecoins: Enables borrowers to draw their loans immediately upon depositing their GWRTs to the protocol. There's no waiting times, just immediate payouts.

Two token model: Splits protocol liabilities into two distinct instruments that serve different user needs:

- USDai (liquid): A zero-yield token used for payments and utility. Holders accept no yield in exchange for liquidity for instant swaps. The cost to the protocol for this capital is approximately 0%.

- sUSDai (staked): A yield-bearing token representing senior tranched debt against GPUs. The cost to the protocol for this capital runs 7-15%.

All of the reserves sans-GPU lending are held in US Treasuries. Those holding USDai forgo all yield, which is passed onto sUSDai. If 20% of the protocol's supply sits in USDai earning 0% and 80% sits in staked sUSDai, the blended cost of capital drops dramatically compared to a fund where all investors expect returns.

As an example, if the private credit charges 13% for a loan, USD.AI can lend at 12%, as the "free float" of non-yielding USDai effectively subsidizes competitive borrower rates.

Why the lowest cost always wins

Financial history follows a consistent pattern across asset classes and decades: capital flows to the most efficient structure.

ETFs replaced mutual funds largely because of lower fees. Index funds captured trillions from active managers for the same reason.

In each case, the product with the lowest cost of capital eventually dominates its category.

The GPU markets will be no different, particularly because banks are structurally unable to finance the high-growth buildout.

As GPU clouds become standardized assets with predictable cash flows and established secondary markets, the financing will inevitably migrate toward whoever can offer the cheapest capital.

For neoclouds racing to scale their operations, USD.AI provides this cost advantage translates directly into competitive pricing power and sustainable margins over the long term, offering a clear path to funding where traditional finance falters.